In the digital age, where financial transactions are increasingly complex and diversified, understanding and tracking personal finances have become more crucial than ever. It’s not just about keeping a tab on your spending; it’s about gaining control over your financial future. This guide aims to emphasize the importance of monitoring personal finances and provide a step-by-step method to create a personalized spreadsheet template for efficient tracking. For those looking for an advanced, ready-made solution, we’ll also introduce a top-tier personal finance tracking spreadsheet available at IMAPLANNER.

Why Tracking Personal Finances Is Vital

- Awareness and Control: Regularly tracking finances helps you understand where your money is going. This awareness is the first step towards making informed spending and saving decisions.

- Debt Management: By keeping an eye on expenditures and income, you can strategically plan to reduce debts and avoid the pitfalls of financial overcommitment.

- Savings and Investment: Effective tracking allows you to identify areas where you can save more, leading to better investment opportunities and financial security.

- Goal Setting: Whether it’s saving for a vacation, a new home, or retirement, tracking finances helps you set and achieve your short and long-term financial goals.

Creating a Personal Finance Spreadsheet Template

Step 1: Choose Your Platform

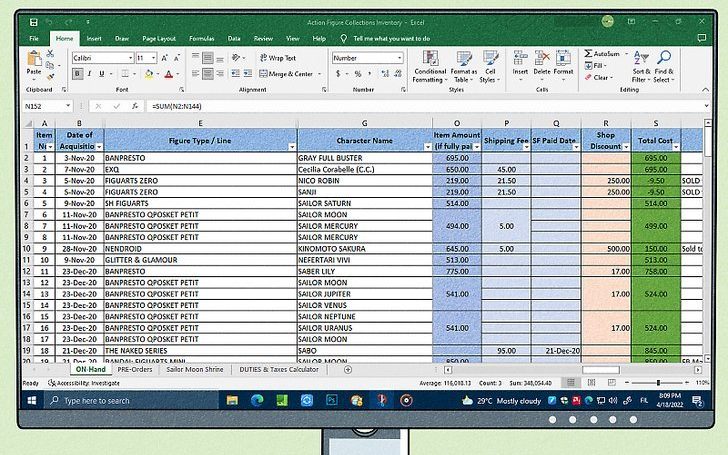

- Excel, Google Sheets, or any other spreadsheet software that you’re comfortable with.

Step 2: Set Up Your Categories

- Divide your finances into broad categories: Income, Fixed Expenses (like rent, utilities), Variable Expenses (like groceries, entertainment), Savings, and Debts.

Step 3: Detailing Transactions

- Within each category, create rows or columns for each specific transaction. Include dates, amounts, and brief descriptions.

Step 4: Monthly Summaries

- Dedicate a section for monthly summaries to compare your income versus expenses. This helps in identifying spending patterns and areas for improvement.

Step 5: Regular Updates

- Update your spreadsheet regularly, preferably daily or weekly, to maintain accurate records.

Step 6: Review and Adjust

- Periodically review your financial status. Adjust your spending and saving habits based on these insights.

Advanced Spreadsheet Tracking: IMAPLANNER’s Annual-Monthly Budget Spreadsheet

While creating your spreadsheet is a great start, some may prefer a more sophisticated and hassle-free approach. For them, the Annual-Monthly Budget Spreadsheet by IMAPLANNER is an excellent choice. This product offers:

- Ease of Use: Pre-formatted and user-friendly, making it easy to start tracking immediately.

- Customization: Tailored to fit various income and expense categories.

- Visual Tracking: Enhanced with graphs and charts for better understanding and analysis of financial data.

- Regular Updates: Keeps your financial tracking up-to-date with the latest features and improvements.

Conclusion

Tracking personal finances is a fundamental step towards financial literacy and independence. While a self-made spreadsheet is a great tool to start with, for those seeking a more comprehensive solution, the Annual-Monthly Budget Spreadsheet from IMAPLANNER is highly recommended. Remember, the key to financial well-being lies in being informed, disciplined, and proactive in managing your money.

Start taking control of your financial future today. Create your own spreadsheet or simplify your financial tracking with IMAPLANNER’s expertly crafted spreadsheet. Visit IMAPLANNER to learn more and purchase this essential tool for your financial journey.